Market Update – Banks In the Spotlight

Investment Update – 26th May 2023

Market Overview

Banks back in the spotlight

In January, Silicon Valley Bank (SVB), the 16th largest lender in the US, collapsed into administration. In the UK, HSBC stepped in to rescue SVB’s UK operation, a key lender for technology start-ups in Britain. The rest of SVB was ultimately acquired by First Citizen’s Bank in March. The bank failure had the effect of putting other regional US banks in the spotlight, with the concern that customers might move to larger, stronger institutions. The aftershock of the bank’s demise also reached Europe, specifically impacting Credit Suisse, which was forced into a deal with Swiss rival UBS.

SVB’s downfall highlights the risks faced by banks that lack adequate controls. Its collapse is likely to mean higher borrowing costs for early stage growth companies. It is perhaps worth noting that we have very little invested in banks and the banks we do have exposure to tend to be large, stable businesses. Moreover, customers of smaller banks tend to move to larger banks when there is news of stress in the banking sector.

The global financial sector is likely to experience further challenges in the coming months given the rapid rise in interest rates over the past year. In equity markets, the banking sector bore the brunt of the negative sentiment, with the FTSE Banks sector falling 12% in March. However, we are not expecting a repeat of the 2008 financial crisis.

UK Economy

Considering the UK economy, the outlook has improved marginally, with growth rising to 0.3% in January from a 0.5% contraction in December. The Bank of England (BoE) expects that the UK economy will avoid a recession this year, and the Office for Budget Responsibility (OBR) has upgraded its forecast for growth in 2023 from -1.4% to -0.2%.

Consumer sentiment has shown signs of improvement, with consumer confidence gradually increasing since the shock of the mini budget in September. Retail sales have been stronger than expected in the first quarter and the labour market remains robust, with low unemployment rates and a significant number of job vacancies. Wage growth is supportive of the recovery, albeit unlikely to maintain pace with inflation.

Although there are positive developments, there is cause to be wary about persistent inflation, running at over 10% with food price inflation running at 20%. There is also weakness in the housing market as rising interest rates push mortgage rates up and house prices pull back.

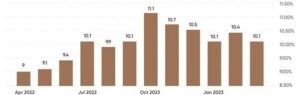

UK Inflation has peaked but will remain stubborn

Source: ONS

UK interest rates – still rising, but at a slower rate

Source: Bank of England

Oil

The oil price has fallen significantly since last autumn, largely due to concerns about global economic outlook, but also due to Russia’s ability to maintain production and supply to key markets such as China and India, despite sanctions. Conversely, OPEC has decided to support the oil price above $80 per barrel, with an unexpected production cut of over 1 million barrels per day.

Oil price (Brent Crude)

Source: Bloomberg

China

The reopening of the Chinese economy following the end of the zero COVID policy at the end of 2022 has raised hopes regarding China’s contribution to global economic growth. However, the recovery has been slow due to the prolonged shutdown, and the economy is unlikely to fully recover until next year. Furthermore, the Chinese government seems to be prioritising consumer led growth rather than investment led growth. Hence consumption is expected to be the primary driver of the Chinese economy, at the expense of infrastructure and investment.

UK & Europe

One major political development in the quarter was the introduction of the Windsor Framework, an agreement between the UK and the EU that adjusts the Northern Ireland Protocol. For goods in transit from Great Britain to Northern Ireland, those intended for sale within Northern Ireland will no longer undergo extensive checks but will enter through a “green lane,” whereas goods destined for the Republic of Ireland or the EU will be subject to third country standard checks and will enter through a “red lane.”

The Windsor Framework has the potential to initiate a more positive and constructive relationship with Europe, which is crucial for the UK to attract international investors, something that has proven challenging since Brexit.

UK equity market

Recent headline news has focused on UK companies deciding to list elsewhere, particularly in the US, further raising concerns regarding the relative standing of the UK market. One example is British microchip designer Arm, based in Cambridge and owned by SoftBank, which now plans to list in New York rather than London. Major UK listed international companies are exploring relisting overseas to achieve higher valuations.

Despite these headwinds for the UK market, the macroeconomic conditions are expected to be favourable for UK equities in the latter half of the year. We are cautiously optimistic regarding consumers and the wider UK economy, which stands to benefit when interest rates eventually peak.

The UK equity market remains relatively inexpensive, offering good value in key sectors than the US and Europe. Balance sheets are generally strong, and dividends are healthy and growing again. Sterling has found strength after the weakness experienced in 2022, and the government appears to have achieved relative stability. Therefore, there is a good chance that both domestic and international investors will increasingly recognise the value in the UK market.

We are thrilled to have joined

We are thrilled to have joined