Market Update – Dark Skies

Investment Update – Dark Skies – 14th February 2022

Overview

Investors experienced mixed results in the fourth quarter of 2021, as equity markets rose in the US, UK, and Europe, but fell in China and were generally weak in the rest of Asia and Emerging markets. There were jitters in November, partly due to fears of the new Omicron variant of Covid-19, but also due to concerns about the speed of withdrawal of financial support measures and the prospect of rising interest rates, in the US and elsewhere. Toward the end of the year these concerns eased as economic data continued to suggest a reasonably stable global economic recovery.

The recovery continues, albeit unevenly across global regions and sectors. In 2020, the pandemic triggered extreme support measures from governments and central banks to bolster demand, amid one of the sharpest economic contractions in modern history, and these policies led to a rapid economic recovery. However, these support measures are now being withdrawn and this requires extra vigilance.

In the US and the UK, employment support measures came to an end in the third quarter, while similar programs across European countries expired in December. Earlier this month, the Bank of England ended its government bond purchase program, which was designed to support the financial system, and the US Federal Reserve will do the same by March 2022. Interest rates, which fell to record lows in the wake of the pandemic, are now rising. In the UK, rates rose from zero to 0.25% in December, and then again by the same amount in the new year.

It has been a volatile start for markets in 2022. The tech sector, which had risen to dizzying heights in 2020, went into reverse toward the end of 2021 and this sell-off continued in the new year. Equity markets are mostly influenced by investors’ expectations of the future. In the early stages of the pandemic, the US market rallied despite the impact of lockdown, as investors focused on the promises of vast levels of government and central bank support, including ultra-low interest rates. Now that this is all coming to an end, equity markets are weighing up various risks and potential headwinds that are likely to rear their heads in the next 6-12 months. The concerns focus mainly on three elements:

1 – Inflation

Inflation is rising in many parts of the world, including the US and the UK. The recovery in global demand is undoubtedly positive, but energy prices have been rising, and supply chains face ongoing disruption, driving price rises across various sectors. Certain sectors of the labour market, such as the service sector, have struggled with staff shortages as lockdown has ended and this has put upward pressure on wages. As inflation becomes more evident, there is the risk of a rise in inflationary expectations, which could lead to stronger wage demands, and eventually an inflationary spiral. Central banks need to work to contain inflation and manage inflationary expectations in order to prevent this from happening.

At the end of 2021, the US Federal Reserve (the Fed) signalled a change in policy, having spent much of the year asserting that inflation was ‘transient’ and there was no need to raise interest rates. We now know that there will be tightening after almost two years of extremely easy financial conditions, and over a decade of relatively easy financial conditions. The age of low interest rates and quantitative easing is coming to an end, and our economic system must transition to a world of more ‘normal’ interest rates (although there is an ongoing debate about what ‘normal’ means). Some equity markets, particularly in the US, are priced for the blue sky scenario of a controlled and uneventful transition to a higher interest rate environment. History would suggest that this is a time for caution.

2 – Slower economic growth

The healthy economic growth experienced in the last year, and the positive earning growth companies enjoyed, was fuelled by easy financial conditions and vast government spending packages around the world, including the $1.9 trillion fiscal package in the US. Furthermore, as lockdowns eased, pent up demand was released, boosting growth. This year the stimulative policies are due to end and pent up demand will wane. These elements are likely to represent a drag on growth in 2022. For firms, alongside the prospect of slowing growth, there are concerns about rising costs due to upward wage pressure and higher taxes.

This is before considering any further impact of Covid 19. Higher vaccination levels have had a significant impact on the threat of the virus, but the emergence of the contagious Omicron variant is a reminder that no one can predict what will happen next in the life cycle of a pandemic. A new wave could perpetuate behavioural shifts in consumers and businesses, restricting activity and putting an additional strain on financial systems while encouraging inflationary pressures due to renewed supply chain disruption.

3 – Valuations in the equity markets

Some regions and sectors of the global equity market are expensive by any metric, particularly the US tech sector, whereas other markets are more fairly valued. These distortions have started to revert, as a sell-off of the more speculative US tech stocks started toward the end of 2021 and continued into the new year. The European markets are more reasonably valued and the UK is still heavily undervalued on global comparative.

The situation in Ukraine

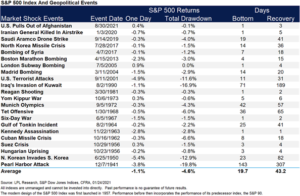

One other source of potential concern is the escalating situation in Ukraine. However, research suggests that markets tend to ride out geopolitical events (despite how awful they may be), See below a selection of past geopolitical events and the US S&P500 reaction to them. However, it is clearly difficult to make comparisons, and the analysis doesn’t account for the prevailing market conditions or the economic environment at the time.

Reasons for optimism

Although we fully expect more volatility and uncertainty to follow the initial wobbles at the start of 2022, there are also reasons for optimism.

The spike in pressure on inflation is likely to ebb toward the latter part of the year. The end of loose financial conditions and support measures will remove significant drivers of upward price pressure and supply chain issues should ease if we are spared new Covid variant induced lockdowns. People are likely to start returning to the job market as household savings are depleted. This may mean that central banks have less work to do to contain inflation.

In addition, while the US and other economies are tightening, in Europe, government spending will continue. Furthermore, China is going in the opposite direction, reducing interest rates and increasing government spending. These measures are likely to offset the gap we expect the US to leave in its contribution to global economic growth.

Considering equity markets, Europe and the UK have not experienced the same levels of market exuberance and excesses that the tech dominated US market has. As activity levels return to normal in the real economy (at the expense of the virtual) the UK and Europe may outperform in 2022. As discussed in previous updates, UK shares are significantly undervalued on a global view.

The UK market trades at more than a 40% discount when compared to the global market:

Source: Morgan Stanley Research. 1 January 1988 to 30 November 2021. MSCI UK vs MSCI World

Summary

Against this backdrop, we remain disciplined in sticking to our investment philosophy. Our portfolios are well diversified and designed to reduce volatility, and it is important to maintain a long term investment horizon in these uncertain times. Within equities, given the risk posed by inflationary pressures and rising interest rates, we are increasingly focusing on companies that a) have significant pricing power (ie where customers won’t be deterred if the price goes up), and b) have strong balance sheets which can withstand increases in borrowing costs (as interest rates rise).

We are thrilled to have joined

We are thrilled to have joined