Market Update

Investment Update – 11th June 2021

What a difference a year makes. 2020 was a year of distortions in global markets, and wild swings in sentiment, from panic to euphoria. In 2021, although many distortions persist, there are signs of a return to rational behaviour. The technology sector, having been one of the main beneficiaries of excess liquidity in 2020, retreated in the first quarter. Conversely, the energy and financial sectors, which languished for most of 2020, continued their recovery at the start of the year. In general, sectors that are more sensitive to the economic cycle have been the strongest performers so far this year, whereas “defensive” sectors, such as utilities, consumer staples, and health care, have lagged.

One key development in 2021 is that inflationary trends have started to emerge, and the main effect of that on markets has been that bond prices have fallen.

The economic outlook continues to be dominated by two key elements; the ongoing impact of the virus on businesses and consumers, and the financial levers available to central banks and governments. The current expectation is that global growth will bounce back strongly in 2021, driven by vaccine roll-outs in major economies, lower prevalence of the virus, and the effects of extreme levels of monetary and fiscal stimulus.

Given this optimism, it is worth considering what risks may lie ahead. This note will focus on the US, given that the US economy is leading the recovery in the West.

Covid-19 Update

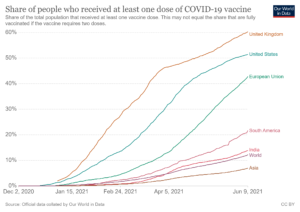

According to the US Federal Reserve (the Fed), the virus remains the biggest threat to the financial system. Progress on vaccines in the UK and US encourages cautious optimism, enabling increased activity, employment, consumer spending, and driving corporate earnings. However, the vast majority of the world has not received a vaccine and there is, therefore, risk from the spread of new variants, leading to renewed lockdowns.

Economic Policy & Risk of Overheating

Governments and central banks around the world have used unprecedented levels of fiscal and monetary policy to combat the economic effects of lockdown. As a result, the US is expected to lead the West out of recession and expand by 6% in 2021, the fastest pace of growth since 1984.

In March, the US government approved the $1.9 trillion ARP (American Rescue Plan), which is equivalent to around 9% of US GDP. Together with the two previous relief packages in 2020, the total US stimulus will be over 25% of GDP, which, to put this into context, is five times the relief package related to the 2008 Great Financial Crisis. Turning to monetary policy, the Fed has maintained interest rates at near 0% and is not planning to reduce its $120bn per month quantitative easing (QE) asset buying program any time soon. After years of inflation below the 2% level, the Fed now aims to encourage inflation to exceed 2%, and has committed to not raising rates before 2024.

These stimulus efforts are being applied to an economy which is already rebounding due to the roll-out of vaccinations. This explains why Wall Street is so bullish, but has implications for market distortions and inflation.

Market distortions

In the US and the UK, households have accumulated savings through lockdown. In many areas that is simply because people have been restricted in their spending. In the UK households saved £7,000 on average in 2020. In the US households have accumulated over $2 trillion in excess savings since the start of the pandemic.

Small investors are increasingly having influence over the market’s overall direction, according to a recent report by the Bank for International Settlements. In the first quarter, over 1 million new brokerage accounts were opened, with American households investing their government stimulus cheques. Individuals are more likely to buy a company’s shares for reasons unrelated to its underlying business, and this was illustrated by the astounding case of Gamestop in January. Private investors bid up the price from under $4 to over $480 in a battle with hedge funds, who were positioned for the price to fall via short selling.

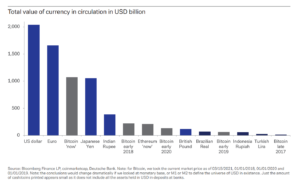

Private investors are also known to buy cryptocurrencies, which in aggregate are now worth around $2.4 trillion, which is larger than all US dollars in circulation by value. We would question whether Bitcoin and other crypto assets can be compared to traditional currencies, but their sheer size generates headlines. In the first quarter, Bitcoin exceeded the size of the Japanese Yen, until its recent 30% crash, which highlights its instability as a currency.

Other asset markets are similarly distorted. Investors have been buying the bonds of junk rated companies at historically low yields, and the residential property market is strong. Crashes in cryptocurrency, tech stocks, or junk bonds could cause knock on effects for households.

Inflation

Inflation has not been an economic problem in recent history, but it is perhaps more of a risk now entirely because it has been so benign in the last few decades. This has led policymakers, consumers, businesses, and investors to become complacent. Understandably, the Fed and other central banks are leaning toward generating inflation. A deflationary spiral is considered even more damaging to an economy than inflation. However, a ‘goldilocks’ level of inflation may be a hard target to hit.

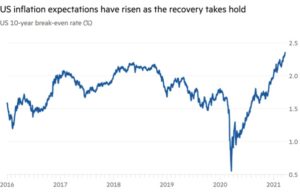

Over the course of this year, the headline inflation rate is likely to spike higher, initially due to commodity price inflation and supply chain bottlenecks. There was a jump in March due to the year on year comparisons given the low prices in March 2020. Perhaps more interesting is the impact that the initial uptick in inflation will have on expectations of inflation.

Expectations of inflation can lead to a self-fulfilling cycle of higher real inflation. Consumers bring forward their spending if they expect prices to rise, businesses do the same and may also raise prices to maintain profit margins. Employees demand higher wages to compensate for higher inflation, businesses raise prices further to offset their higher input costs and inflation increases again leading to expectations of more inflation.

The hope is that inflation will be contained because there is significant spare capacity in the economy, which means there is significant unemployment and underutilisation. Hence there is no pressure for wages to rise. In addition, the fiscal stimulus is temporary and when it ends, the effect will become fiscal drag. Lastly, disinflationary forces, such as technology, automation, and demographic trends, remain.

Market Overvaluation

The US stock market is still expensive relative to historical averages across a wide range of metrics. The Fed has warned that markets are vulnerable if investor risk appetite falls, progress on containing the virus falters, or the recovery stalls. At the end of April, Fed Chairman Jerome Powell said markets looked “a bit frothy”. Equity markets are priced almost to perfection, assuming interest rates will remain unusually low for a long time. Although persistent inflation seems unlikely in the short term, we are likely to see inflation spikes, causing market jitters. Equity valuations at current levels can only be justified if interest rates stay extremely low, so the market will be vulnerable if interest rates need to rise in order to counter Inflationary pressures.

Conclusion

The most likely scenario over the next year is that there will be a continued theme of reflation, (ie a return to an inflationary environment) supporting global equity markets. Corporate bonds are likely to outperform government bonds, and alternative strategies should outperform bonds in general. Our portfolios are conservatively positioned this year as the US and global economy continue to recover, and we expect pandemic news flow and inflation spikes to cause market wobbles. This environment also offers opportunities for active management across both equities and fixed income to add value relative to market indices.

We are thrilled to have joined

We are thrilled to have joined