Market Update – Light at the end of the tunnel

Investment Update – 17th February 2023

The fourth quarter offered some respite to global investors, as equity and fixed income markets partially recovered at the end of a very challenging year. There were indications that inflation had peaked, enabling central banks in the major economies to consider slowing the pace of interest rate rises.

Earlier in the year, significant inflationary pressures emerged following the invasion of Ukraine. The war impacted key commodity prices, compounding existing inflationary pressures which had emanated from the economic recovery following the lifting of pandemic induced restrictions. As a result, in 2022, inflation reached levels that had not been seen in developed economies for 40 years. This had not been anticipated by markets and central banks at the start of the year and proved to be the main driver of asset prices over the period. Most central banks raised interest rates aggressively to combat inflation, and this took its toll on economic growth, risking recession.

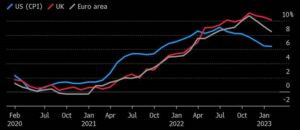

Inflation Source: Bloomberg, UK ONS, Eurostat, US Bureau of Labor Statistics

Source: Bloomberg, UK ONS, Eurostat, US Bureau of Labor Statistics

UK consumer price inflation rose to over 11% at the start of the fourth quarter with core inflation, excluding food and energy, at 6.5%. However, the figures for November suggested an easing of pressure. A similar effect was seen in the US and Europe, potentially enabling central banks to ease their plans to tighten financial conditions. Interest rates are now expected to peak in mid 2023.

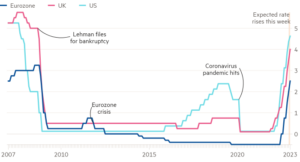

Interest rates

Source: FT, BIS, ECB

In the UK, the government’s disastrous mini budget in September caused market chaos, specifically in the gilt market, but the subsequent Chancellor’s Autumn Statement helped somewhat restore the UK’s financial credibility, and sterling started to recover. The Bank of England raised interest rates by 1.25%, bringing the headline figure to 3.5%.

Meanwhile, labour markets have remained tight in the UK, Europe and the US, but inflation and higher borrowing costs have impacted consumer spending. The UK and Europe are teetering on recession, and although the US has proved more resilient where energy prices have caused less stress, the risk of recession is ever present.

In China, the zero-Covid policy and extensive lockdowns caused difficulties in the region throughout 2022, but an announcement, at the beginning of December, that this policy was to end provided optimism for global investors.

Market Overview

Global equities fell sharply in 2022, mainly due to fears of recession. However, large companies in the UK fared relatively better due to specific sector exposure (such as energy, mining, and healthcare), significant overseas earnings, and relatively cheap valuations. In contrast, the more domestically focused smaller and medium sized UK companies did not fare so well.

Bonds started the year with extremely low yields, and the impact of unexpectedly high inflation and significant interest rate rises led to a very difficult environment for fixed income assets in 2022. However, in the fourth quarter conditions eased and UK bonds recovered somewhat from the calmer political environment. It is still shocking that UK gilts lost -23.8% in 2022, and UK corporate bonds fell -17.7%.

Conversely, returns on cash deposits have improved significantly following the rise in UK interest rates to 3.5%.

World Equity Index (ACWI), UK Corporate Bond Index (SLXX), UK Gilt Index (IGLT)

Outlook

Before 2022, the world had enjoyed a long period of relatively low inflation, with extremely supportive central bank policies, and the positive effects of globalisation. Now, the impact of the pandemic and geopolitical developments have significantly changed the investment environment, with inflationary pressures necessitating a rapid rise in interest rates, causing economic slowdown and risk of recession. Central banks have been aggressively trying to rein inflation back towards target levels of around 2%, and there is a danger that they may now over-tighten conditions, weakening economies. However, once it is clear that inflation is on a downward path, central banks may be in a position to ease policy tightening and perhaps even reverse course to support economic growth.

There are reasons to believe that economies will be resilient in the face of these headwinds: labour markets are still strong, governments are generally supporting growth via fiscal policy, and there is an overhang of consumer savings from pandemic induced lockdowns. In addition, the Chinese economy is opening following the relaxation of their zero-Covid policy which should release some pent-up demand once the initial chaos subsides. In the past, severe economic downturns have been characterised by excessive valuations or where the banking system is vulnerable. The rapid moves in interest rates and bond yields have exposed some stresses in the financial system, but central banks have shown their willingness to act. A deep recession is unlikely given the relative financial strength of banks and overall corporate health.

Equity Markets

Despite the risk and uncertainty, there are reasons to be optimistic. Asset prices have already factored in a lot of bad news and, as ever, markets tend to look to the future. Equity markets were impacted by a deteriorating outlook for GDP growth and corporate earnings, and the impact of higher interest rates and bond yields on valuations, especially those of more growth-oriented companies such as technology stocks. However, sectors such as energy, mining, healthcare and consumer staples have performed relatively well, hence the relative resilience of the UK market. Whilst the outlook for the UK economy is relatively challenging, the UK equity market is likely to continue to benefit from its exposure to the sectors mentioned, its significant international revenue exposure, and its relative cheapness vs the rest of the world. In addition, various large UK companies also have attractive dividend yields and are potential targets for corporate activity. Whilst there remain elevated risks to the short term economic and corporate outlook, the medium to long term perspective still offers the potential for growth.

During the pandemic, US equity markets benefitted from their exposure to growth stocks – specifically technology companies – and the strength of the dollar. Although these dynamics reversed in 2022, US equities remain relatively expensive on the world stage. The European market had suffered initially due to the war in Ukraine and concerns over energy supplies, but investor confidence is now returning. In Emerging Markets, China and India are dominant drivers and offer the potential for long term outperformance. China faces its own challenges, as tensions with Taiwan and the wider relationship with the US are an ongoing concern, and the economy has also been impacted by their zero-Covid policy, restrictions on the private sector, and its property market weakness. Nevertheless, the relaxing of lockdown restrictions should boost growth in 2023.

Bonds & Cash

The sharp fall in bond prices has been painful for investors and there are still risks of further falls if inflationary pressures don’t ease as expected. However, bonds are better value than they have been for many years and now offer more meaningful diversification to portfolios. UK government bonds now offer yields around 3-4%, with corporate bonds yielding nearer 5%. The investment opportunity set has also widened now that there is interest on cash, albeit still well below current levels of inflation.

Summary

Market uncertainty remains elevated with high levels of inflation and interest rates putting pressure on consumers and economies. Although this has created a challenging investment environment including some significant falls on bond investments, there are early signs that inflation may have peaked and that the bulk of interest rate rises is now in the past. Investors should draw optimism from the fact that markets have already anticipated, and therefore factored in, a lot of bad news and so may react positively as conditions improve. Moreover, cash and fixed income assets are offering better value than we have seen for a long time. In equity markets the risk remains that corporate earnings could deteriorate if economies weaken further, but many UK and international equities now offer good value. Despite the ongoing challenges, diversified portfolios containing equities, fixed income, and infrastructure offer the potential to deliver attractive returns over the medium to long term.

We are thrilled to have joined

We are thrilled to have joined