Market Update – A stormy week in UK markets

Investment Update – A stormy week in UK markets – 30th September 2022

A stormy week in UK financial markets

What happened?

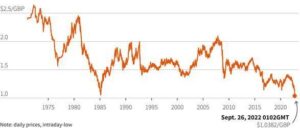

Last Friday, Kwasi Kwarteng, the new Chancellor of the Exchequer, set out details of his mini budget. Although he may have expected a positive response, his speech caused shock waves in financial markets. After announcing the biggest package of tax cuts in the last 50 years, it became clear that there was no equivalent plan to cut government spending. Markets reacted badly to the concept of unfunded measures and sterling fell sharply to a record low of $1.035 on Monday, although it has since recovered. The price of 10-year UK government bonds also fell alarmingly as yields rose.

Sterling falls to an all time low against the US dollar (50 year chart)

Source: Reuters, Refinitiv Datastream

10 year government bond yields rose sharply as government bond prices fell (20 year chart)

Source: Politico, Bank of England, IMF

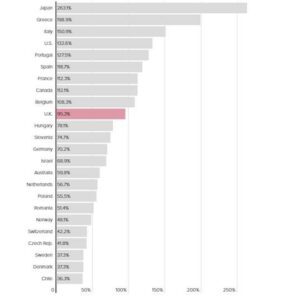

The overall concern is clearly about UK government finances. Although the debt level is high, it isn’t extreme from an international perspective.

Government Debt as a Percentage of GDP

Source: Politico

The International Monetary Fund (IMF) made their concerns clear, stating “We do not recommend large and untargeted fiscal packages at this juncture, as it is important that fiscal policy does not work at cross purposes to monetary policy”. In plain English, this means government spending should not work against the Bank of England’s need to raise interest rates in order to control inflation. Indeed, the Bank will need to raise interest rates faster following the mini budget. On Monday, financial markets indicated that investors were expecting the Bank to raise interest rates from 2.25% to 3.75% in November, and then up to 6% by mid 2023. If this turns out to be true, it will simply increase the headwind that the UK economy is already facing. If interest rates do not rise as much as expected, sterling could fall further, increasing pressure on inflation as imports become more expensive.

Following the sharp fall in government bond prices, large pension funds faced a funding crisis, and on Wednesday, the Bank announced it would purchase long dated government bonds in the coming weeks “to restore orderly market conditions”. The Bank’s actions seem to have successfully restored stability.

However, the prospect of higher interest rates remains. This will impact borrowers, including the government itself. Homeowners with mortgages will feel pressure. Some mortgage lenders have suspended some mortgage products. Every month around 100,000 mortgages come to the end of their fixed-rate mortgage period, rising to 125,000 mid 2023. If interest rates rise as investors expect, refinancing an average two-year fixed-rate mortgage in the first half of next year could mean monthly repayments jumping by around 70%.

Businesses will also be affected as borrowing costs rise, and rising interest rates will also raise unemployment and impact GDP. It is hard to believe the Bank will go quite as far as the market currently expects, given the impact that would have on the economy. In the last 50 years the Bank has never persisted raising interest rates after house prices have started to fall.

What does all this mean?

Markets have somewhat calmed down from the initial turmoil, and we expect there will be a tempering of the government’s initial plan to avoid further chaos.

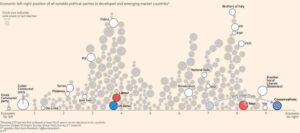

The current policy position is quite remarkable, as the following chart shows. Following the mini budget, the government is now considered the most economically right wing party in the developed world.

Economic left-right position of political parties

Source: FT

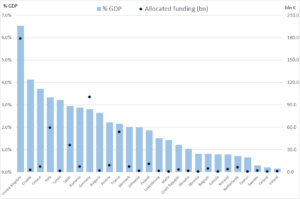

This might seem surprising given the UK is leading Europe in protecting consumers and businesses from the cost of energy prices:

European Governments Spending to cushion energy crisis

Source: Bruegel

The government needs to convince key institutions and investors that the plan is sustainable. Adding spending cuts to the mix and achieving a reasonable assessment from the Office of Budget Responsibility (OBR) would go a long way to restoring confidence.

What does this mean for my portfolio?

We invest on a global basis, and as with previous UK dramas, our exposure to the UK is relatively modest. In equities, the investments we have in UK listed companies are generally multinational, meaning they earn a large proportion of their revenue overseas. This means that sterling weakness is actually supportive of portfolios, although clearly there is still pressure on markets across the globe related to inflation (in the US, Europe and elsewhere) and rising interest rates.

As ever, we won’t gaze into the crystal ball (which we know to be permanently broken). However, at times like this, it is always wise to take stock of the wider investment environment. A long term investment strategy should adjust according to market conditions, but history tells us not react to short term noise. Turbulence often offers active managers the opportunity to find value, taking a longer term view on the prospects for quality companies

We are thrilled to have joined

We are thrilled to have joined