Market Update – U-turn

Investment Update – 1st December 2022

So far, 2022 has been a difficult year for investors. Inflation and the impact of the war in Ukraine remain key concerns, and the need to raise interest rates at a time of slowing economic activity increases the likelihood of a global recession.

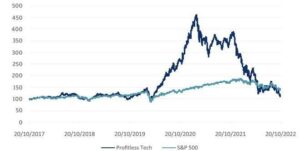

The outlook for financial markets deteriorated in the third quarter. In the US, the bubble in the technology stocks continued to deflate, in Europe, the energy crisis continued to weigh on sentiment, and in China, the economy has been hampered by covid-19 lockdowns. For international businesses, higher input costs and labour market tightness, specifically in the US, are likely to continue to squeeze corporate margins and therefore profits.

Goldman Sachs unprofitable technology index vs the S&P500

(The bubble in technology stocks continued to deflate in the third quarter…)

Source: JPM

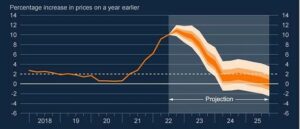

Inflation reached 11.1% in the UK in October, whereas in the US, the headline figure fell from 8.2% to 7.7%. Inflationary pressures seem to be easing in both the UK and US.

In recent months, following the chaos of the mini budget and the subsequent policy U-turn by the government, UK financial markets have stabilised and, next year, headline inflation is expected to fall. As we approach the anniversary of Russia’s invasion of Ukraine, the year on year comparisons of energy prices will no longer look back to before the war, when oil and gas prices were cheaper. That will take a chunk out of headline inflation, and will help ease inflationary expectations.

Expected Inflation Range (CPI projection)

Source: Bank of England (based on market interest rate expectations, other policy measures as announced)

Inflationary pressure has been easing as pandemic-related disruptions to supply chains dissipate. This time last year semiconductors and second hand cars were in short supply, whereas there is now an excess supply of chips and car prices are falling. These dynamics are likely to continue. Only the tightness in the labour market continues to cause upward pressure on inflation and inflationary expectations, suggesting there is more work to be done.

However, in general, as energy prices stabilise and goods prices are expected to moderate, inflation is expected to ease over the course of the next year. These dynamics will allow central banks flexibility to slow the rate of interest rate rises.

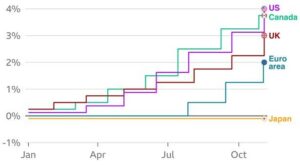

Interest rates in 2022

Source: Bank for International Settlements and central banks

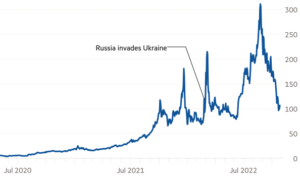

Turning to Europe’s energy crisis, gas prices have fallen due to a combination of mild weather and decent storage. However, Europe’s economy is likely to be contracting and the period of energy shortage is expected to last at least two years. On top of this, without gas from Russia, storage levels are likely to deplete. The challenge is that inflation and inflationary expectations have become entrenched due to higher energy prices. Across Europe wage growth is rising and inflation expectations are creeping higher, making it harder to fight inflation while supporting the economy.

European natural gas prices

(TTF front-month contract (€ per MWh)

If there is a particular source of optimism, China has the potential to surprise positively in 2023, as it recovers from the zero-covid policy and weakness in the property market. A loosening of lockdown would boost growth, although we can’t rule out a rise in infections, in a population that has seen little exposure to the virus. In support, the Chinese government has unveiled measures to ease the financial pressure on embattled property developers.

Despite these headwinds, we remain opportunistic. Often these are the times when great opportunities emerge. Although conditions deteriorated in the third quarter of the year, there are reasons to be optimistic given that markets are well placed for recovery, and certain regions and companies now look very attractive in historic terms. As financial conditions stabilise, the outlook for multinational companies with robust business models is attractive. In the short term, equity markets are likely to remain volatile as interest rates rise further and expectations about the economic impact on company earnings remain pessimistic, but the longer term picture is positive.

We are thrilled to have joined

We are thrilled to have joined