Market Update

Investment Update – 15th June 2020

The global economy

Only a few months ago, the prospect of a global pandemic was not a serious threat, and the world had relatively little knowledge about coronavirus. Now, with immense global resources devoted to understanding, suppressing, and ultimately beating the virus, governments are in a better position to protect people and economies. Fears about the pandemic and the subsequent economic crisis have given way to considerations about the extent and shape of the recovery.

However, the world is still in a precarious state. The International Monetary Fund (IMF) is expecting the global economy to suffer its worst downturn since The Great Depression of the 1930s, and for the first time since then, advanced economies, emerging markets, and developing economies are all in recession at the same time. This year, growth in the advanced economies is projected to fall around 6% and emerging market and developing economies are expected to contract by 1%. All economies are expected to recover in 2021.

Market reaction

Mercifully, markets don’t tend to move in line with economic growth.

Initial concerns about the recessionary impact of lockdown around the world resulted in the sharpest fall in stock market history in March. Yet April was the market’s best monthly performance in thirty years, and markets continued to rise in May. Information moves stock markets, and markets are able to factor in new information very quickly. The bounce was caused by government and central banks around the world launching vast stimulus packages, providing lifelines to businesses and people. The US Federal Reserve (the Fed) led the way, cutting interest rates to zero, and committing to unprecedented levels of quantitative easing (QE).

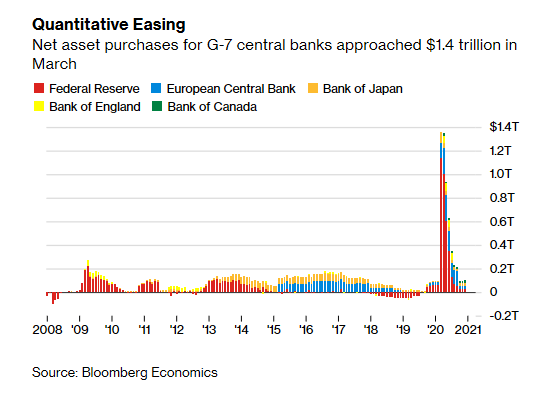

Quantitative easing was pivotal in supporting the financial system after the last financial crisis in 2007-08. However, the extent of the QE this time is larger by several orders of magnitude:

The central bank and government stimulus packages have driven the market recovery, even though the ultimate effect of the stimulus is unknown.

The nature of the crisis

Given such extreme market moves, it is worth taking a step back to consider the longer term and compare this crisis to other crises in history. For our investment team, this is our third downturn, and at times like this we look to the past to try to understand the future. Markets tend to move in cycles around a generally upward trending growth line. Market crashes tend to be caused by financial events, and then the downturn is accelerated by a recession. The current crisis has not been caused by an event within the financial system, but rather an external healthcare crisis, and this has left many economists and market commentators perplexed.

The future hinges on several factors of which economists have little or no experience, such as the effectiveness of containment measures, the epidemiology of the virus, and the development of therapeutics and vaccines. Although policymakers are providing unprecedented levels of support to households, firms, and financial markets, there is considerable uncertainty about what the global economy will look like when the world emerges from lockdown. The equity markets are assuming that the pandemic will fade in the second half of 2020, and that policy actions taken around the world will be effective in preventing economic ‘scarring’ in the form of widespread bankruptcies, mass unemployment, and excessive disruption to the global financial system.

Winners and losers

Recent corporate results have mostly reflected the uncertain environment by projection lower earnings expectations and many firms have cut their dividend. However, large corporates reacted quickly to the crisis by preserving cash, and, with the help of government and banks, they have shown the market stronger balance sheets and slower cash burn than was expected in March.

A company’s share price is the reflection of all its future earnings. When there is news that impacts a company’s future earnings, its share price moves quickly to reflect the new information. In March the only information available was the rapidly spreading virus and the impending impact of lockdown. Now, share prices have rebounded as investors look toward the recovery in earnings expected next year.

In terms of sectors, the recovery was led initially by technology, healthcare, and consumer staples companies. This also helps explain why markets bounced back so quickly in the context of significant economic uncertainty. For example, in the US, big technology stocks (such as Facebook, Amazon, Netflix, Google, and Microsoft) outperformed the market due to the resilient and rising demand for their products and services in lockdown. The stocks represent 20% of the S&P500 index and yet only contribute around 4% to the US economy. So, while they have played a disproportionate role in the market recovery, their impact on the economy is relatively muted.

Companies that rely on free movement, such as travel, tourism, and hospitality, underperformed significantly. In addition, resources companies suffered due to the collapse in the oil price, and banks faced concerns about loans, despite being much better capitalised when compared to the last downturn (the Global Financial Crisis of 2007-8). The challenge for many companies will be how to transition from a world of lockdown and extensive government support to a world of lower than normal activity and less government support. Many retailers, restaurants, and bars will struggle to survive if customer numbers are limited to 30% for an extended period. A return to any semblance of normality will be slow as social distancing persists. Consumer footfall will be lower, and commuters and travellers will remain wary of confined spaces. Hence, some firms in these sectors will not survive, and many will be absorbed by stronger rivals.

In terms of countries and regions, those dependent on the sectors listed above (travel, tourism, hospitality, and resources) are likely to take longer to recover. Emerging market and developing economies with limited capacity for government spending and weaker health systems will face additional challenges. Lower global risk appetite will impact flows of capital to these regions and, put pressure on their currencies.

The recovery

The road to full economic recovery will be long. The most immediate hurdle to overcome is the threat of a second wave of infections, but studies show that pandemics tend to have long lasting effects. It will take time for confidence to return among consumers, businesses and investors. People are likely to be more aware of the vulnerability of their employment and income, causing them to save more for bad times, which means weaker consumer spending. Business investment is also likely to be weaker as the lockdown and fall in economic activity has brought with it a greater awareness of the risks to business. So, as the pandemic recedes, savings rates are likely to be higher and capital expenditure is likely to be lower, which will mean lower growth.

Lower growth also suggests interest rates will remain low, and not return to ‘normal’ for an extended period. Government spending will need to be higher to offset slower growth in the private sector, which will add to the already burgeoning government debt mountain. The International Monetary Fund (IMF) forecasts that total government debt for the G20 will rise to 150% of GDP by the end of 2021. Given that governments won’t be in a position to cut spending, taxes will need to rise, but also, governments will be encouraged to target higher inflation, in order to erode the real value of the debt.

Conclusion

The world now has a much greater understanding of how to contain the spread of the virus. Although there is the risk of a second wave as restrictions are lifted, we know that the spread can be reduced through distancing measures and testing to ensure the infection rate remains below one. Meanwhile, the global race to create a vaccine continues, although clearly the likelihood and timing of any breakthrough is entirely unknown. AstraZeneca expects to know in the next month whether the trial for their vaccine, developed in partnership with Oxford University, has been successful.

No one knows how the pandemic will play out, but we expect that the global economy will still be feeling the effects long after a vaccine is found. However, as we have seen, this does not imply that investment portfolios will face the same headwinds. As the former CEO of Intel, Andy Grove, once said “Bad companies are destroyed by crises; good companies survive them; great companies are improved by them.” Against this backdrop, we remain disciplined in sticking to our investment philosophy. Our portfolios are well diversified and designed to reduce volatility, and it is important to maintain a long term investment horizon in these uncertain times. Within equities, we continue to focus on companies with strong balance sheets, dominant market positions, and the potential to generate cash, and these are the companies that will emerge stronger over the next few years.

We are thrilled to have joined

We are thrilled to have joined