Market Update – Wild Swings!

Investment Update – 1st November 2023

Market Overview

Global equity markets experienced wild swings in the third quarter of 2023. Having started the quarter optimistically, global investors increasingly focused on the challenging outlook for inflation, economic growth, and the growing expectation that interest rates will remain higher for a longer period than previously expected.

It is worth considering 2023 in light of the challenges of 2022. Last year, the spike in inflation surprised central bankers and financial markets. Central bankers needed to raise interest rates aggressively to reduce inflation pressures, engineering a slowdown in most advanced economies. As a result, the start of the year was characterised by concerns over inflation, and fears that urgent tight monetary policy would cause recession. Over the course of the first half of the year, however, there was growing optimism that inflation was under control and the global economy would achieve a soft landing.

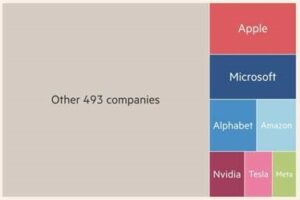

Stocks initially performed well in the first half of the year, as fears of inflation and recession ebbed. Technology stocks, which had suffered the most in 2022, bounced furthest. These tech stocks also found strength due to the emergence of generative artificial intelligence (AI), promising to enhance their business models . Seven key US tech companies dominated the S&P 500, namely Apple, Amazon, Microsoft, Tesla, Alphabet (Google), Meta (Facebook) and Nvidia (which makes graphics processors). The following chart illustrates this effect (repeated from last month).

Share of S&P500 according to size (market capitalisation)

(Note: Alphabet = Google, Meta = Facebook, and Nvidia makes computer chips)

Source: FT, Refinitiv

However, in the third quarter, pessimism returned. Stock markets lost momentum against a background of a weakening global economic outlook.

The initial easing of US inflation seemed broad based during the first half of the year, aided by the absence of energy price inflation, but in June, the oil price rose sharply. Saudia Arabia, the biggest OPEC producer, had forecast a deteriorating economic outlook, and decided to cut production in order to support the oil price. Russia followed suit, restricting output, tightening the global market further. More generally, oil producers have been resistant to investing too much in fossil fuel extraction, concerned that demand is likely to be lower in the future due to regulations and the demand for cleaner fuel sources. This lack of investment will mean lower future supplies, adding to upward price pressure. Perversely, in the long run, higher oil prices are likely to promote faster adoption of clean fuel technology, which may ultimately release pressure on oil supplies.

Brent Crude Oil Price Rises to 10-month high ($ per barrel)

Source: LSEG, Reuters

Economic outlook

Economic signals around the globe were mixed over the quarter, and the outlook for the global economy remains uncertain. In the US, a strong job market was offset by a survey of business conditions which suggested stagnation in economic activity. Most major economies are experiencing a slowdown in demand, but so far consumption in the US has proved relatively resilient. In the UK, September’s Purchasing Managers’ Index (PMI), an indicator of business activity, pointed to a contraction during the month.

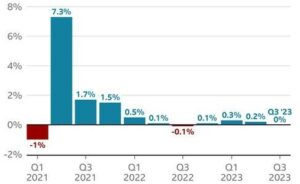

UK economic growth remains week (quarterly GDP growth)

Source: ONS

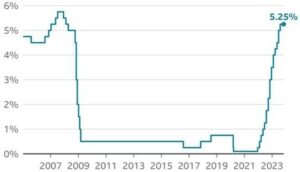

The Bank of England raised the headline interest rate for the 14th consecutive time at the August meeting, by 0.25% to 5.25%. Since then however, rates have remained unchanged.

UK interest rates

Source: Bank of England

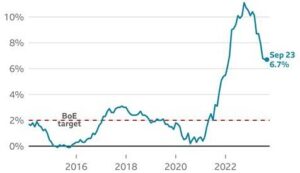

Higher interest rates are having the desired effect of bringing down inflation in the UK, as CPI inflation fell to 6.7% in August although the figure remained the same in September. Higher energy prices are being offset by lower food inflation. However, UK inflation is expected to fall further as last year’s jump in energy costs falls out of the annual figures in October. The bank has maintained that the inflation target remains 2% – there is clearly a long way to go from here.

UK inflation

Source: ONS

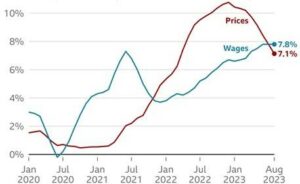

Wage inflation in the UK is also expected to ease as wage rises now exceed the slowing inflation figure.

UK wages overtake inflation

Source: ONS

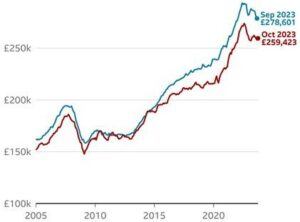

House prices in the UK have been relatively slow to adjust to higher interest rates. This may be partly due to the fact that a significant number of households do not have a mortgage at all, and those that do have mortgages tend to be on fixed-rates. The effect of higher interest rates is now being felt however, as those fixed rate deals come to an end and much more expensive mortgages loom.

House prices fall – Halifax (blue line), Nationwide (red line)

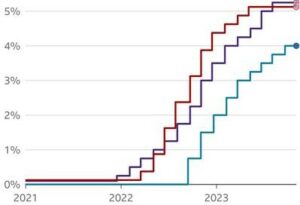

Interest rates in the UK, US, and Europe, are expected to fall from current levels and settle at a lower rate over the coming years. The question is how fast they will fall and at what rate are they likely to stabilise.

Interest rates – US (red line), UK (purple line), EU (blue line)

Source: BOE, The Fed, ECB

The expectation that interest rates have peaked indicates that there is value in the fixed income market over the medium term, often offering a combination of capital appreciation and yield to maturity.

Summary

Despite these headwinds, we remain opportunistic. Often these are the times when great opportunities emerge. Although conditions deteriorated in the third quarter of the year, there are reasons to be optimistic as economies return to normal, and certain sectors and asset classes now look attractive in historic terms. As financial conditions stabilise, the outlook for multinational companies with robust business models is attractive, and there is value to be found in bond markets. In the short term, equity markets are likely to remain volatile, but the longer term picture is positive.

We are thrilled to have joined

We are thrilled to have joined