Market Update – Interest Rates Start To Bite

Investment Update – 4th August 2023

Market Overview

In the second quarter of 2023 equity markets rose strongly despite aggressive interest rate hikes by central banks.

Interest rates start to bite

Typically, higher rates act as a headwind to equity investments. This is partly because the return on cash becomes more attractive, but also because higher interest rates raise the cost of borrowing, affecting indebted companies and mortgage owners. Higher interest rates are designed to slow demand growth, which impacts company profitability. Furthermore, higher interest rates also reduce the present value of future earnings for companies, which impacts company valuations. For markets to perform well when interest rates are rising, investors need confidence that company profits are resilient and will continue to grow.

The optimism in the quarter stemmed from the perception that the interest rate raising cycle may be coming to an end. During the quarter, the Federal Reserve (the Fed) avoided one opportunity to raise interest rates and then only increased rates by 0.25% at the next meeting. This doesn’t suggest that interest rate rises are over but it does suggest the raising cycle is slowing. As well as the Fed, the European Central Bank and the Bank of England are working to engineer a slowdown in economic activity to get a grip on inflation, but they must also be careful not to overdo the tightening, and risk causing a recession.

Inflation eases

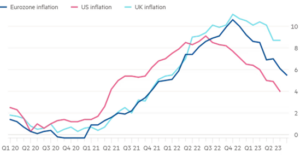

Inflationary pressure started to ease in the major economies, with the US further ahead in the cycle than the UK and Europe.

Annual Percentage Change in Consumer Prices

Eurozone harmonised index of consumer prices, US and UK consumer price inflation

Source: FT, ONS, Eurostat, US Bureau of Labor Statistics

Several sources of inflation have reversed course and are now exerting downward pressure on prices. Many of the supply chain bottlenecks that added to inflationary pressure in 2022 have been resolved. Furthermore, commodity prices, which usually have a significant impact on inflation, have generally been falling, although the ongoing war in Ukraine has prevented many commodity prices from falling further. In June, the counteroffensive by the Ukrainian army and a rebellion in part of Russia’s mercenary army, the Wagner Group, weakened the Russian leadership and emboldened Ukraine.

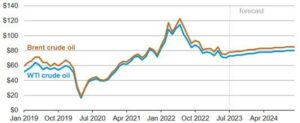

The oil price fell during the quarter due to concerns about recession and the impact on demand, despite OPEC (The Organisation of the Petroleum Exporting Countries) limiting crude oil production, due to their fears of oversupply.

Crude Oil Prices (US dollars per barrel)

Source: EIA

Food prices decreased in general in the quarter. Although many countries have banned imports from Russia, previously imported food is being sold to countries not observing Western sanctions, lowering global prices. However, the effect was not felt in the UK which is facing import frictions, and is the sixth largest importer of food in the world. Food price inflation has reached 20% over the past year.

So in general in the UK, although falls in energy prices are helping with overall inflation, food prices continue to cause upward pressure.

Contribution to annual CPI inflation

Source: Bank of England

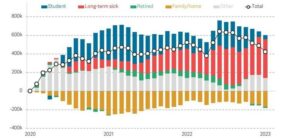

Core inflation, which excludes food and energy prices, continued to rise throughout the quarter. Another key challenge has been the tightness in the labour market, partly due to an increasing number of potential workers being unable to work due to health reasons.

Economic inactivity among 16-64 year olds since 2020 by reason

Source: Resolution Foundation, ONS, Labour Force Survey

Inflation remained unexpectedly strong in the quarter, as the Bank of England continues to assess whether further action is required to reign in inflationary pressure, following the decision to raise rates in July.

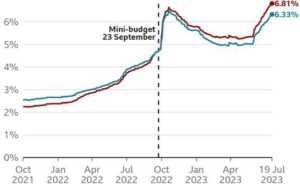

UK property market headwinds

Historically, the UK property market has been reasonably sensitive to interest rate changes, given the prevalence of relatively short term fixed rate mortgages. However, in recent years, the percentage of homes that are owned outright has increased to around 33% of properties, whereas 28% of properties are owned with a mortgage. A wave of mortgage deals is set to expire in the coming months, two years after the stamp duty holiday that encouraged many people to buy. Given that mortgage rates have risen significantly since then, the second half of 2023 may be challenging for many mortgaged homeowners in the UK.

Average interest on 2 year and 5 year fixed mortgage deals, UK

Source: Moneyfacts

Having said all of that, higher interest rates aren’t all bad. Higher rates suggest a return to a more normal economy following the abnormal period of ultra-low interest rates between 2009 and 2022. With bonds providing more attractive returns, investment portfolios can be more balanced, and therefore more resilient to shocks.

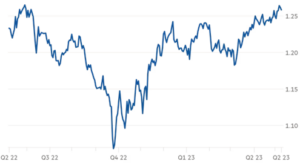

Sterling’s bounce

The pound has recovered against the US dollar since the weakness following the mini budget of 2022.

USD per GBP

Source: FT

A narrow rally in markets

Surprisingly, technology shares, which are usually vulnerable to rising long term interest rate expectations, performed well in the quarter. The market rally was highly concentrated in a few stocks; indeed, seven of the largest US companies, accounting for 15% of the global equity market, far outpaced the broader market.

Share of S&P500 according to size (market capitalisation)

(Note: Alphabet = Google, Meta = Facebook, and Nvidia makes computer chips)

Source: FT, Refinitiv

These companies are perceived as beneficiaries of the growth in Artificial Intelligence, supporting chipmakers, cloud storage, and other technology related sectors. However, given the market rally has been concentrated in so few stocks, it should be treated with scepticism. Investors should have learned from the very recent bubble in tech stocks during the pandemic, which inevitably deflated in 2022. Artificial Intelligence is clearly in its infancy and it will take many years for the winners and losers to become apparent.

Although the threat of further interest rate rises and the potential of a recession is ever present, we are cautiously optimistic. As ever, we remain disciplined in sticking to our investment philosophy. Our portfolios are well diversified and designed to reduce volatility, with a focus on investing for the long term.

We are thrilled to have joined

We are thrilled to have joined