Market Update

Investment Update – 24th February 2021

A year of extremes

2020 was a year of extremes, in markets, economics, and politics. The coronavirus rapidly evolved into a pandemic, which in turn caused a global economic crisis, and policymakers were forced to act swiftly and aggressively to counter the impact of lockdown on businesses and individuals. It was a year of high drama in politics, culminating in the messy end of Trumpism and a conclusion to Brexit which seemed to satisfy no-one. At the end of the year, positive vaccine news brought new hope to a sombre world, and an uneasy sense of relief, followed by a misplaced sense of euphoria in global equity markets.

This was an astounding end to the year, given that in March, the world was facing the largest contraction in over a century. At the low point in the year, it would have seemed foolish to expect that markets might recover by the end of the year, but many sectors did, and some stocks even rose above pre-pandemic levels.

Unprecedented stimulus

2021 saw levels of fiscal and monetary support around the world that had never been seen before. The US government injected $3 trillion of stimulus, via borrowing and spending, and another $3 trillion stimulus by buying bonds, a type of quantitative easing. European policymakers responded similarly. Interest rates around the world were reduced to near zero, and further into negative territory in Europe. More proactive stimulus is expected, especially in the US under the new Biden administration.

This tsunami of money has undoubtedly prevented several damaging effects of recession, so far. In the past, when the world has faced recession and unemployment has reached the levels seen in 2020, firms and consumers would start to default on loans and mortgages. This would cause tightening at the banks, leading to a sharp contraction in lending. However, in the US at least, defaults have not yet risen significantly. Government support to firms and individuals in the form of loans and furlough schemes has prevented credit tightening. Consumers have continued to spend and save, and banks are still in a position to support the recovery via lending. This bodes well for the anticipated recovery once restrictions are lifted, but it is a stretch to think that there will be no price to pay for the massive increase in government debt and the prolonged shutdown. Employment levels will take time to recover, and many firms will decide to close when support measures are removed.

Winners, losers and the risk of a bubble: The US and tech sector leave the world behind

After the initial fall in March, regions and sectors of the global stock market diverged significantly.

The FTSE100 recovered from losing 34.3% at the low but still ended the year 15.0% down, hampered by exposure to sectors such as oil and gas and banks. In contrast, US markets bounced strongly due to the increasing dominance of the tech sector. Tech companies positively benefitted from the effects of lockdown, pushing the S&P500 up by 15.3% (in USD) by the end of the year. Other regions and markets diverged too, with Europe (Eurostoxx 50) ending down 5.9%, China (Shanghai Composite) up 12.6%, and the Hong Kong (Hang Seng) down 4.6%, (all in local currencies).

As Mark Twain said, history does not repeat, but it rhymes. This is not the dot.com boom. Some of the well known technology businesses have benefited significantly from economic lockdowns as shopping and working from home have become the new way of life. Microsoft is in a sweet spot of digital transformation, cloud computing and home working. Amazon continues to steal business from traditional high street shops.

So, it is clear that the dramatic outperformance of some tech firms was justified.

However, it is also true that easy money has been chasing more speculative tech ideas, which is harder to justify. Goldman Sachs constructed an index of non-profitable US tech firms, and the shape of the curve in 2020 is quite startling:

(This index includes firms such as Pinterest, Peloton & Uber)

The steep rise in valuations follows the massive government and central bank stimulus in March 2020, suggesting the impact of easy money flowing into the tech sector. In one respect, many of the names in this index are high-growth businesses which should be reinvesting revenues and therefore we shouldn’t expect them to be declaring profits at this stage in their evolution. However, there is evidence of speculative behaviour here and elsewhere in the high growth technology sector, which encourages extreme caution.

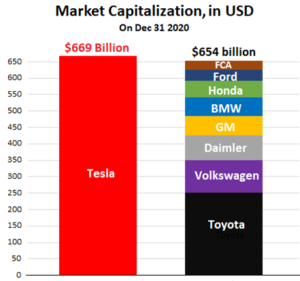

One clear example of overvaluation is Tesla, which has a global car market share of only 0.7%, and is only marginally profitable, and yet is now worth more than all other major car manufacturers put together:

We remain wary of these distortions and excesses and, as ever, are focused on more stable multinational firms with robust business models, whose balance sheets have remained resilient through lockdown and stand to do extremely well as the world economy gradually opens up. More traditional business examples include Reckitt Benkiser and Unilever, businesses with strong brands which are well positioned to adapt and benefit from the new domestic focused, hygiene-conscious economy. Reckitt Benkiser has shown strong growth in sales for hygiene products such as Dettol and both Reckitt and Unilever have benefited from selling low cost essential items (such as Unilever’s Dove soap), via the internet and supermarkets that were largely spared the impact of lockdown.

This is not to say that we avoid the tech sector altogether. For example, Microsoft is demonstrating clear growth and therefore does make it into our portfolios, whereas Apple has shown virtually no growth in operating profits for the past five years, and hence does not feature. Yet both stocks have been driven up by the general enthusiasm for tech.

At the year end, we were left wondering whether the general recovery in asset prices, and the extreme outperformance of certain stocks and sectors, could be justified given the damage caused to the global economy, especially given that the damage was still ongoing, and in fact was nowhere near finished.

The future

The growing availability of several effective vaccines is clearly good news for businesses, economies, and society in general. Investors are now able to look beyond the current lockdown and anticipate a return to normality due to the distribution of the vaccines. As restrictions ease, economic activity will inevitably jump in 2021 (from last year’s depressed levels), with policymakers providing ongoing stimulus to support the recovery. However, the global pandemic will have left a scar on the global economy and perhaps a permanent shift in societal attitudes.

As lockdowns ease, and consumption levels spike upwards, the levels of stimulus will quickly taper off. Policymakers will be left to assess significantly higher levels of government debt, and will need to decide which taxes are least likely to offend a weary Populus. Households may be inclined to save more and spend less in the next few years.

It is hard to judge how the current economic environment will affect inflation, given that both poth positive and negative pressures remain in the global economy. However, we note that instruments designed to guard against inflation such as US TIPS (Treasury Inflation Protected Securities, bonds whose coupons adjust for inflation), have performed particularly well in anticipation of a resurgence in inflation.

What does all of this mean for Oakham portfolios?

In our last note, we highlighted that we have reduced risk in portfolios given the bounce in markets. We have lowered exposure to stock markets, in anticipation of further swings and wobbles. As society returns to near normal, focus will shift toward the damage caused to economies and the enormous debt generated. The euphoria caused by vaccine developments will be replaced by the realisation that we face a long road to normality.

Some new and evolving investment themes…

The pandemic has accelerated some investment themes and generated some new themes that will endure. The trend toward remote and flexible working has accelerated, as has the trend toward digitalisation. The pandemic has increased awareness of the risks presented by climate change and the need to reverse and mitigate the damage. There is a growing sense of social responsibility and a growing need for more sustainable capitalism. Lastly, there is a clear increase in the demand for hygiene and healthcare. These themes present opportunities.

…but the strategy remains the same

Market sentiment has evolved from panic to optimism over the last few months, and indicators of investor sentiment have surged to levels which suggest there is risk of a bubble, especially in certain sectors. As ever, our portfolios are well diversified and designed to reduce volatility. We continue to focus on large multinational companies that benefit from long term trends which are more structural and less cyclical. Strong global companies with healthy balance sheets will weather the current storm better than their competitors, and opportunities for growth will arise as less robust companies succumb to the headwinds.

We are thrilled to have joined

We are thrilled to have joined